Need Help? Call

(336) 588-7769

Final Expense

Leave Memories For Your Loved Ones - Not Burdens

Final expense insurance is a whole life policy with a small death benefit and is easy to get approved for. The beneficiaries of a final expense policy often use the payout — typically between $2,000 and $40,000 — for end-of-life expenses, like a funeral or memorial service, embalming, a casket, or cremation. However, the beneficiaries can use the death benefit for anything, such as paying medical bills or property taxes, or even taking a vacation.

We Are Here To Help!

Reach out to us today to find the coverage you need!

The Final Expense Market

Unfortunately, death is inevitable, and it leaves bills that have to be paid. The good news is that a permanent insurance policy can help.

Final expense insurance is intended for people between ages 50 and 85 who are starting to consider their funeral costs. Final expense may be right for you if:

• You are retired

• You no longer have life insurance through your employer

• You don’t have an individual life insurance policy

• You don’t have comfortable savings and are concerned about leaving your loved ones with a financial burden when you pass away.

Why Final Expense?

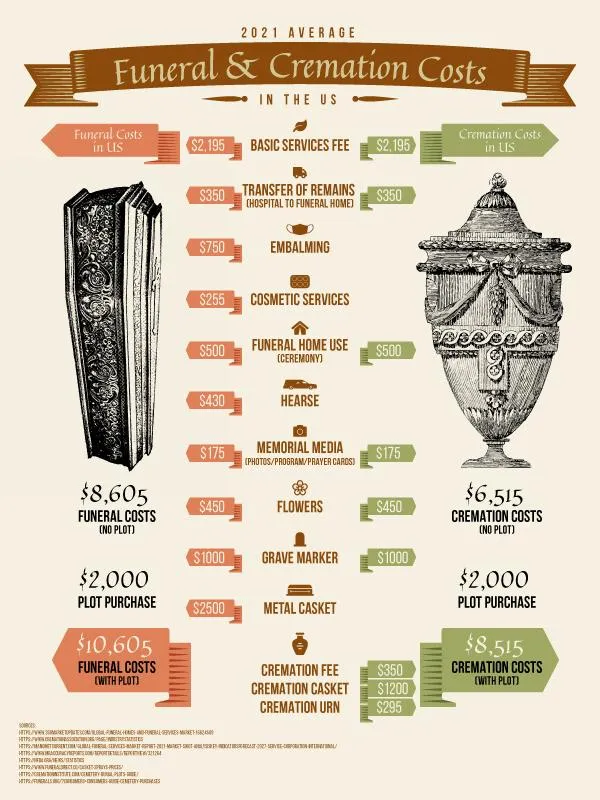

According to the National Funeral Directors Association, the average cost of a funeral (with a viewing) and burial is around $10,605, while the average cost for cremation is $8,515. The Social Security Administration provides a very small death benefit of $255 to each senior who fits within the guidelines. However, in many cases, it could take months to even get a payment.

Funeral homes expect to receive their money quickly, and most seniors on a fixed income tend to struggle to pay the rising cost of an unexpected funeral bill — for a spouse or loved one. The good news is that most people between the ages of 50 and 85 will qualify for final expense insurance, a state-regulated program designed to pay the entire cost of a burial or cremation in one tax-free payment to your beneficiary.

Average Cost of a Funeral

Affordable Premiums

The premiums for a typical life insurance policy may not be affordable due to your age and health. With final expense, most seniors can still get a policy despite their health. And the smaller death benefit makes final expense premiums more affordable.

Pros And Cons

You should know this: the cash value of a final expense policy accumulates tax-deferred. Here’s a quick side-by-side look at the pros and cons:

- Available to those with poor health.

- Premiums will never go up

- Death benefit is tax-free and never goes down

- Death benefit is guaranteed – as long as you pay monthly premiums

- Beneficiaries can use this death benefit for any purpose.

- You could lose money if you live a long time.

- Some insurers provide incomplete or misleading info about the policies.

- Some folks let their policies lapse, meaning their heirs won’t get the death benefit.

- May not cover full final expenses

Final expense insurance may not help you pay off a large mortgage, but it will at least help your family pay the bills directly associated with your death. These are bills they’ll have more trouble paying without your income or anything else!

Your Loved Ones Trust You, And You Can Trust Us.

When you choose Secrest Financial for final expense life insurance, your policy is backed by our industry experience. Our licensed agents have been in the business for many years, and we take pride in helping people protect their families. Give us a call today to see how we can help!

© 2022 All Rights Reserved. Site design by Black Swan Marketing LLC Terms Of Service | Privacy Policy